Result update| Luggage

August 18, 2018

Safari Industries

BUY

CMP

`868

Another blockbuster quarter…

Target Price

`1000

Robust growth in revenue: For Q1FY2019, Safari Industries (Safari) posted a yoy

Investment Period

12 Months

growth of 49% growth in revenue mainly led by volume growth and low base

Stock Info

effect (Q1FY2018 revenue was subdued due to GST impact). The company has

Sector

Luggage

reported net revenue of `156 cr which was the highest ever revenue achieved.

Market Cap (` cr)

1,934

The company is garnering market share from the unorganized market and seeing

Net Debt (` cr)

52

good demand in its backpacks and new categories which is driving such strong

Beta

0.3

growth in its financials.

52 Week High / Low

898/285

Margins almost doubled on yearly basis: OPM has almost doubled on yearly

Avg. Daily Volume

8,776

Face Value (`)

2

basis to 13.9% led by operating leverage and better product mix. On quarterly

BSE Sensex

37,947

basis also, Margins have improved by over 200 bps on a strong base. The

Nifty

11,470

company is expecting 100-200 basis margin expansion on yearly basis. Looking

Reuters Code

SAFA.BO

at the good demand environment, the company is also planning to move into

Bloomberg Code

SII.IN

premium luggage segment and could soon launch some product in this category.

Earlier, Safari was in wait and watch mode for this category.

Shareholding Pattern (%)

PAT rose by 272% yoy: With a moderate rise in interest and depreciation, PAT

Promoters

57.8

grew to `12.2 cr, a growth of 272% yoy and 58% qoq.

MF / Banks / Indian Fls

15.8

Outlook and Valuation: We remained convinced about its long term growth story

FII / NRIs / OCBs

8.7

as the company is in sweet spot in a fast growing luggage industry. We have

Indian Public / Others

17.7

upgraded our estimates by 30-33%, in view of its improving growth and margin

outlook. We are now expecting a CAGR of ~30%/60% in revenue/ earnings over

Nidhi Agrawal

FY18-20E. The stock has given 67% return since our initiation in April and is

022-39357800 Ext: 6872

currently trading at 35x our revised FY2020 earnings, which is still attractive

looking at its robust growth trajectory. Hence, we recommend BUY with a target

price of `1000 (40x FY2020E EPS).

Key Financials

Y/E March (` cr)

FY2016

FY2017E

FY2018E

FY2019E

FY2020E

Net Sales

278

359

415

540

702

% chg

28.8

29.0

15.8

30.0

30.0

Net Profit

7.8

10.4

21.2

40.8

54.6

% chg

55.9

33.8

103.9

92.3

33.8

OPM (%)

6.7

6.3

9.8

12.9

12.9

EPS (Rs)

3.5

4.7

9.5

18.3

24.5

P/E (x)

248.2

185.5

91.0

47.3

35.4

P/BV (x)

15.0

13.6

7.9

6.5

5.2

RoE (%)

8.5

10.4

12.3

19.4

21.0

RoCE (%)

9.7

12.1

15.2

23.6

26.0

EV/Sales (x)

7.1

5.5

4.8

3.6

2.8

EV/EBITDA (x)

107.2

87.7

48.5

28.0

21.7

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Safari Industries |Result Update

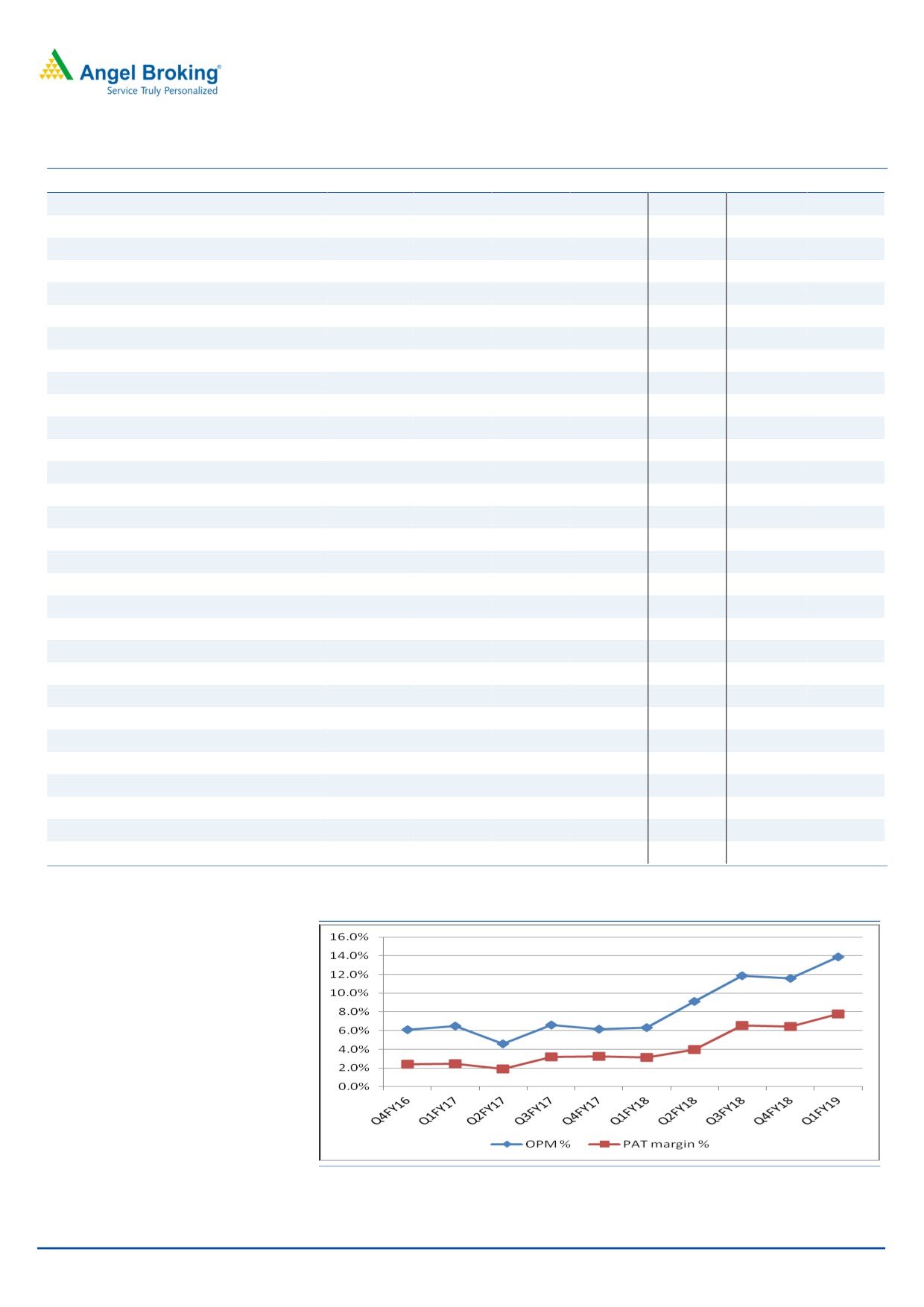

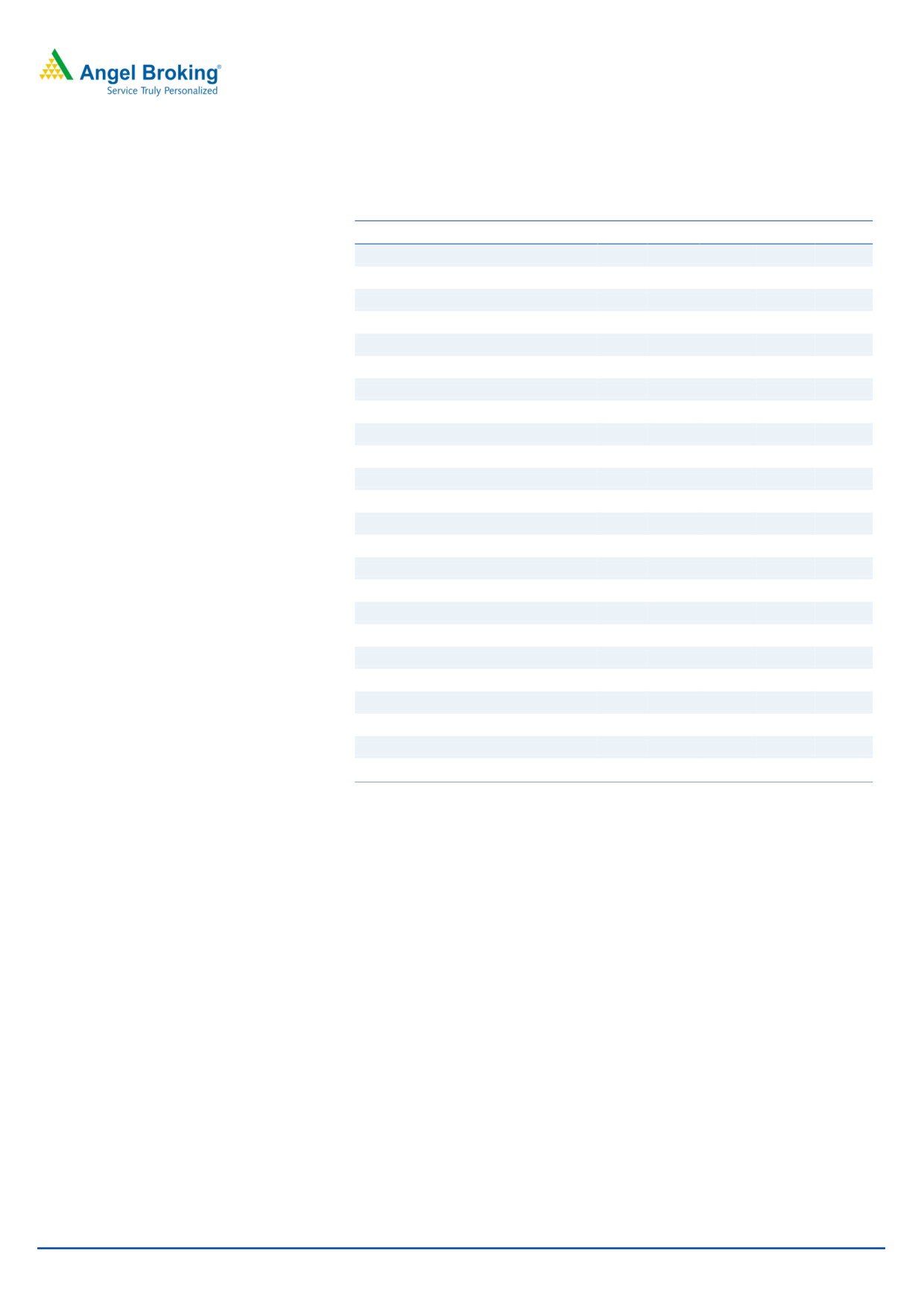

Exhibit 1: Quarterly results at a glance

Rs cr

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

YoY

QoQ

Net Sales

104

88

103

119

156

49%

31%

YoY growth %

25.6%

19.2%

11.5%

25.9%

49.2%

Total expenditure

98

80

91

105

134

37%

27%

Raw Material Consumed

8

6

9

19

17

114%

-7%

Stock Adjustment

8

-1

-13

-12

0

-

-96%

Purchase of Finished Goods

48

39

59

57

70

45%

23%

Employee Expenses

12

13

13

15

16

30%

5%

Other Expenses

22

24

24

27

32

45%

17%

As a % of sales

Raw Material Consumed

8%

7%

8%

16%

11%

Stock Adjustment

7%

-1%

-13%

-10%

0%

Purchase of Finished Goods

46%

44%

57%

48%

45%

Gross margin %

39%

50%

48%

47%

44%

Employee Expenses

12%

14%

13%

13%

10%

Other Expenses

21%

27%

23%

23%

20%

Total expenditure

94%

91%

88%

88%

86%

Operating profit

6.6

8.0

12.3

13.8

21.6

226%

56.2%

Other Income

0.2

0.2

0.5

0.7

0.3

49%

-55.3%

PBIDT

6.8

8.2

12.8

14.5

21.9

221%

50.8%

Interest

0.5

0.7

0.9

0.7

1.0

91%

45.7%

Depreciation

1.4

1.3

2.0

1.4

1.9

39%

33.3%

PBT

4.9

6.1

9.9

12.4

19.0

285%

53.2%

Tax

1.8

2.6

3.3

4.3

6.8

273%

58.4%

Adjusted Profit

3.3

3.5

6.8

7.7

12.2

272%

58.9%

YoY growth %

61.1%

152.5%

128.3%

150.2%

272.0%

Ratios

OPM %

6.3%

9.1%

11.9%

11.6%

13.9%

PAT margin %

3.1%

4.0%

6.6%

6.4%

7.8%

Tax rate %

37%

42%

34%

34.7%

35.9%

Source: Company

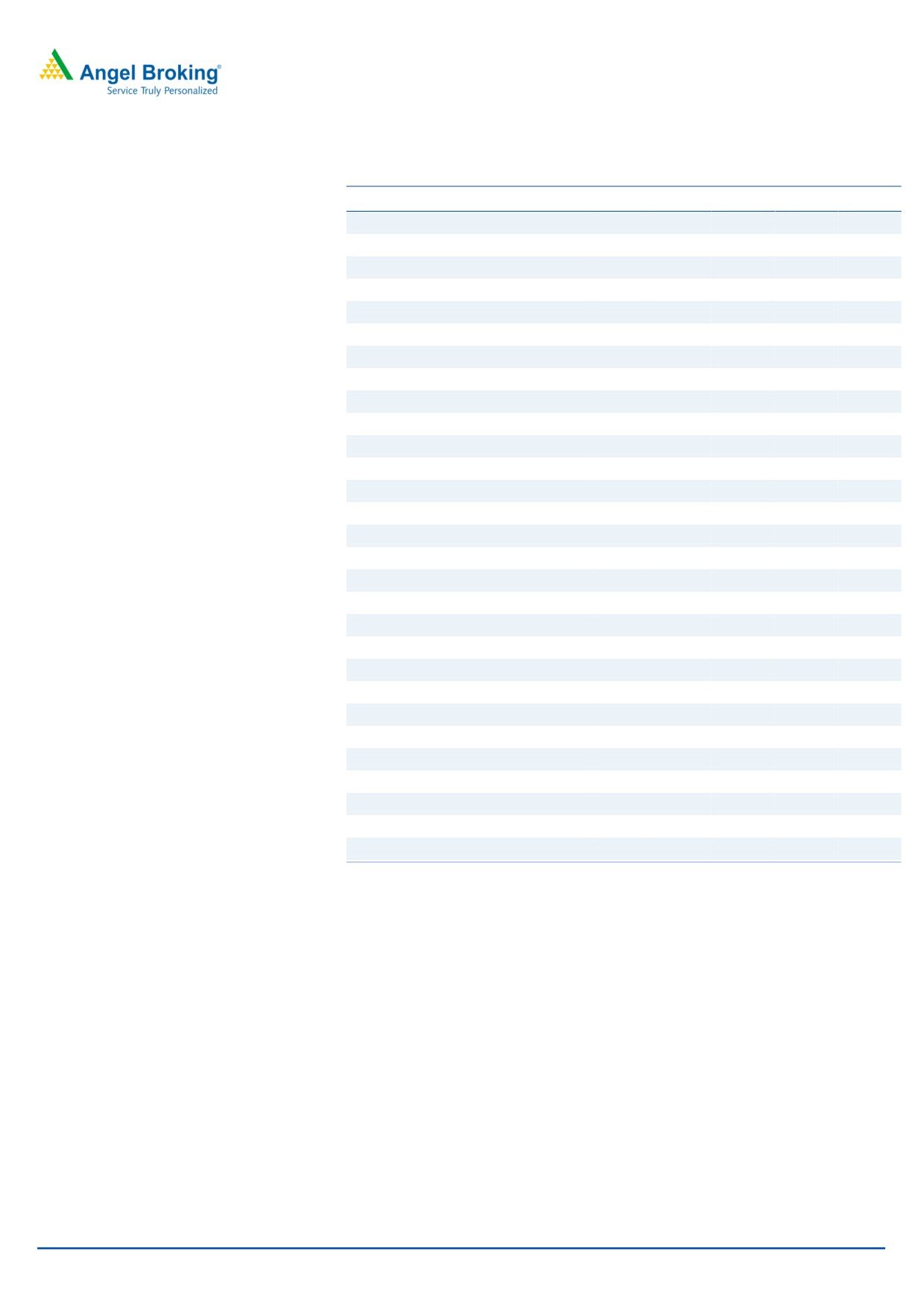

Exhibit 2: Margins are on uptrend

Source: Company, Angel Research

August 18, 2018

2

Safari Industries |Result Update

Risks to our estimates

Volatility in foreign currency could impact the company’s profitability (77% of

its revenue comes from soft luggage, which is imported from China).

With closure of many luggage units in China (owing to pollution concerns),

the surviving suppliers have started taking price hikes which is could put

pressure on its margins, unless price hike is taken.

Increase in competition from unorganized players would impact overall

growth of the company

Safari’s 23% sales comes from hard luggage segment and any increase in

input cost (most of the key raw material is polypropylene and aluminum)

could negatively impact profitability

August 18, 2018

3

Safari Industries |Result Update

Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Total operating income

278

359

415

540

702

% chg

28.8

29.0

15.8

30.0

30.0

Total Expenditure

260

336

375

470

611

Raw Material

173

219

226

298

387

Personnel

29

41

53

59

77

Selling and Administration Expenses

48.1

65.4

96.2

97.2

126.4

Others Expenses

9

10

-

16

21

EBITDA

19

22

41

70

91

% chg

63.1

21.3

81.6

71.2

30.0

(% of Net Sales)

6.7

6.3

9.8

12.9

12.9

Depreciation& Amortisation

4

5

6

7

7

EBIT

14

17

35

63

83

% chg

70.7

20.0

99.9

81.8

32.4

(% of Net Sales)

5.2

4.8

8.3

11.7

11.9

Interest & other Charges

3

3

3

4

4

Other Income

1

1

2

2

2

(% of PBT)

6.5

7.4

4.6

3.1

2.7

Share in profit of Associates

-

-

-

-

-

Recurring PBT

12

15

33.4

61

82

% chg

105.9

25.2

123.1

82.7

33.8

Tax

4

5

12

20

27

(% of PBT)

35.2

34.1

36.4

33.0

33.0

PAT (reported)

8

10

21

41

55

Extraordinary Items

(0)

(1)

-

-

-

ADJ. PAT

8

10

21

41

55

% chg

55.9

33.8

103.9

92.3

33.8

(% of Net Sales)

2.8

2.9

5.1

7.6

7.8

Fully Diluted EPS (Rs)

3.5

4.7

9.5

18.3

24.5

% chg

55.9

33.8

103.9

92.3

33.8

Source: Company, Angel Research

August 18, 2018

4

Safari Industries |Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

4

4

4

4

4

Reserves& Surplus

87

96

168

206

256

Shareholders Funds

91

100

173

210

260

Equity Share Warrants

-

-

-

-

-

Total Loans

58

44

54

57

60

Deferred Tax Liability

-

-

0

-

-

Total Liabilities

149

143

228

267

320

APPLICATION OF FUNDS

Gross Block

42

45

60

70

80

Less: Acc. Depreciation

18

22

28

35

42

Net Block

24

23

31

35

37

Capital Work-in-Progress

0

1

0

1

1

Investments/ Other NC assets

0

-

6

-

-

Current Assets

143

165

244

295

359

Inventories

76

94

123

156

199

Sundry Debtors

54

58

104

89

115

Cash

5

5

3

32

21

Loans & Advances

8

7

2

2

3

Other Assets

-

-

13

16

20

Current liabilities

27

54

53

64

77

Net Current Assets

116

110

190

232

282

Deferred Tax Asset

(0)

(0)

-

-

-

Total Assets

149

143

228

267

320

August 18, 2018

5

Safari Industries |Result Update

Consolidated Cash flow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

12

15

33

61

82

Depreciation

4

5

6

7

7

Change in Working Capital

0

0

(79)

(7)

(62)

Interest / Dividend (Net)

3

3

3

4

4

Direct taxes paid

(4)

(5)

(12)

(20)

(27)

Others

(28)

4

42

1

0

Cash Flow from Operations

(13)

22

(6)

47

4

(Inc.)/ Dec. in Fixed Assets

(16)

(5)

(5)

(10)

(10)

(Inc.)/ Dec. in Investments

1

(1)

0

0

0

Cash Flow from Investing

(15)

(6)

(5)

(10)

(10)

Issue of Equity

7

0

0

0

0

Inc./(Dec.) in loans

3

1

11

3

3

Dividend Paid (Incl. Tax)

0

(16)

(2)

(3)

(5)

Interest / Dividend (Net)

(3)

(3)

(3)

(4)

(4)

Cash Flow from Financing

29

(17)

6

(5)

(6)

Inc./(Dec.) in Cash

1

(2)

(5)

32

(11)

Opening Cash balances

3

4

5

0

32

Closing Cash balances

4

2

0

32

21

August 18, 2018

6

Safari Industries |Result Update

Key Ratios

Y/E March

FY2016

FY2017

FY2018E FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

248.2

185.5

91.0

47.3

35.4

P/CEPS

115.3

90.9

49.8

28.6

22.0

P/BV

15.0

13.6

7.9

6.5

5.2

Dividend yield (%)

0.0

0.0

0.1

0.2

0.2

EV/Sales

7.1

5.5

4.8

3.6

2.8

EV/EBITDA

107.2

87.7

48.5

28.0

21.7

EV / Total Assets

13.3

13.7

8.7

7.3

6.2

Per Share Data- `

EPS (Basic)

3.5

4.7

9.5

18.3

24.5

EPS (fully diluted)

3.5

4.7

9.5

18.3

24.5

Cash EPS

5.3

6.7

12.3

21.4

27.9

DPS

0.2

0.4

0.8

1.5

2.1

Book Value

40.9

44.9

77.7

94.5

117.0

Returns (%)

ROCE

9.7

12.1

15.2

23.6

26.0

Angel ROIC (Pre-tax)

10.0

12.5

15.8

26.7

27.8

ROE

8.5

10.4

12.3

19.4

21.0

Turnover ratios (x)

Asset Turnover (Gross Block)

6.6

7.9

7.0

7.8

8.8

Inventory / Sales (days)

100

96

108

106

104

Receivables (days)

71

59

91

60

60

Payables (days)

92

141

114

114

114

Working capital cycle (ex-cash) (days)

80

14

85

52

50

Source: Company, Angel Research

August 18, 2018

7

Safari Industries |Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Safari Industries

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

August 18, 2018

8